Contents:

An intraday trader must assign the stop loss level beforehand itself. When the stock price reaches the stop loss level, the transaction is automatically terminated. The trader may lose a small sum of money but in the process can protect the capital from eroding too much. Just a word of caution, don’t keep moving your stop loss unless justified. Stop-loss can be your real saviour during a volatile market condition.

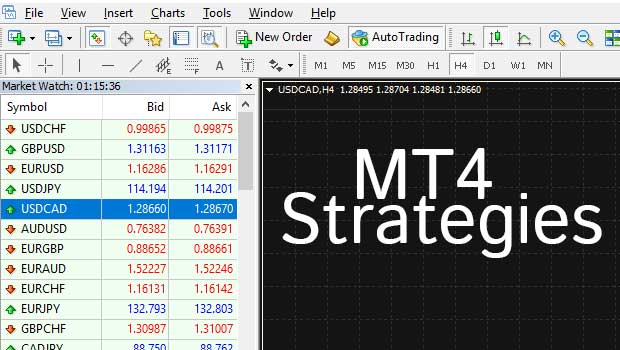

EUR/USD: Possible surprise in NFP in a shallow market creates risks of extreme behaviors – FXStreet

EUR/USD: Possible surprise in NFP in a shallow market creates risks of extreme behaviors.

Posted: Fri, 07 Apr 2023 07:33:43 GMT [source]

This includes the realized and unrealized profit and loss of all the positions. We understand that this might sound a bit complicated to understand, but it gets fairly straightforward once we break it down in the form of an example. Let’s assume we have the following TSL parameters set in a strategy.

For example, if you buy RIL at Rs.2300 and set a stop loss at 0.8%, then your stop loss for buy position will be set Rs.18 lower i.e., at Rs.2282. However, factor in brokerage and statutory costs also when setting stop losses. It is common to have such a question one is trading, how much to set in stop-loss order? Most of the traders use the percentage rule to set the value of the stop-loss order.

Why FIIs are Selling Continuously in the Indian Share Market

Time-bound fixed stops are useful for investors who want to provide the position a pre-set amount of time to profit prior to moving onto the next trade. We have always delivered and prioritised what is required for super traders to manage risk and make trading a better experience. We know, at the end of the day our super traders need two things – manage risk & make profits or minimise losses. Grow is a new addition to the collection broker’s group, and utilizing their Grow Intraday Trading amenities is highly gainful.

- For the sake of simplicity, we will focus only on how to calculate stop loss for intraday trading and not discuss other asset classes.

- Activate at is the PNL after which your trailing stoploss mechanism gets activated.

- Worse still, if the stock soared, you must be cursing your bad fate.

Stop-loss is a tool that investors use to minimise the loss in a trade. Some traders define it as an advance order, which triggers an automatic closure of an open position when the stock price reaches the trigger price level. It is a personal choice to use a stop-loss order strategy in day trading and what is more important is to set the right value for stop-loss orders. Most of the day, traders set the stop-loss value above the price they have bought the stock when the trend is booming upwards. In such a case, if the trend falls or there is a downtrend, the trader at least has some profit in the pocket.

In quick-moving markets, the price paid or got might be very unique in relation to the last price cited before the order was entered. What we traders colloquially call trailing stop loss is in reality a trailing stop loss order. A TSL in an algo setup is not achieved through individual orders but through a calculation based on the overall PNL of your strategy. It is important to note that when the trailing stop loss in an algorithm is achieved, it simply closes all open positions through a Universal exit.

They should determine their stop loss based on technical parameters as discussed above. Another method of placing a stop loss in trading is through the percentage method. You can place a Trailing Stop-loss order as a part of Robo Order in Angel One mobile app following these simple steps.

Stock Analysis

Stockbroker Alice Blue Financial Services Private Limited is also required to disclose these client bank accounts to Stock Exchange. Hence, you are requested to use following client bank accounts only for the purpose of dealings in your trading account with us. The details of these client bank accounts are also displayed by Stock Exchanges on their website under “Know/ Locate your Stockbroker”. To ensure smooth settlement of trades, the investors are requested to ensure that both the trading and demat accounts are compliant with respect to the KYC requirement. Another thing to bear in mind is that your stop order will become a market order once you’ve reached your stop price.

The runtime data is only visible to the creator of the strategy. Finally, keep in mind that stop-loss orders do not guarantee a profit in the stock market; you still have to make wise investment choices. If you don’t, you’ll suffer losses equal to or greater than those you’d suffer in the absence of a stop-loss, albeit at a slower rate. Once the stop loss drops below the stop price, the stop loss order becomes the market order and is executed at the next available price. When the stop loss order is placed, it is an indication by the investor to the agent to sell the security at a pre-set price limit, once the security reaches this limit.

Stop Loss Meaning – What is stop loss order in the share market?

Small recap, in stop loss, the https://1investing.in/ bought a stock at Rs 100 and set a stop loss at Rs 90. Read on because this may be a more crucial tool than your analytical ones. However, stop-loss orders come with their own share of disadvantages as well.

A how a strong vs. weak dollar affects u.s. jobs order is a purchase or offers order to be executed quickly at the current market prices. However long there are willing vendors and purchasers, market orders are filled. Market orders are utilized when sureness of execution is a need over the price of execution. This order type doesn’t permit any control over the price got. The order is filled at the best price accessible at an important time.

But the nature of this stock, when it starts falling, it can fall too much and I can lose most of the profits that I’ve already made here. So if Jindal Steel and Power comes down to 201 rupees, I want to sell, half of what I have, let’s say 150. A stop loss order is an order placed to sell a stock when it reaches a certain price.

Book Value Per Share (BVPS): Formula and Calculation 2023-24

Vinayak aims to empower newbies with relatable, easy-to-understand content. His ultimate goal is to provide content that resonates with their needs and aspirations. Stop-loss market order is the case when you set a price to prevent losses and get what you expect, well almost. At this point it is important to note that the TSL works on a strategy level and not on a set level. Thus the overall PNL calculation for TSL happens on the realised as well as the unrealised profit or loss of your strategy. This means that the trailing stop loss is not currently activated.

Comparing Yield Farming vs Staking: How to Make Safe and Smart … – msnNOW

Comparing Yield Farming vs Staking: How to Make Safe and Smart ….

Posted: Sat, 08 Apr 2023 22:11:52 GMT [source]

For a company’s common shares trading at Rs 400 a share, a stop loss may be issued in case the price is expected to fall, with the stop-loss price being Rs 380. Should the share price continue falling and go below Rs 380, the investor’s shares are sold automatically. While setting a couple of values in some boxes may be easy, it’s always a good practice to check how and where the trailing stop losses trigger in order to optimise a strategy.

So a lot of you are working professionals who have portfolios with investments in stocks and ETFs. One of the scariest things that can happen to your portfolio is that one of your stocks may start falling like a rock and you don’t even come to know about that several days later. I know this because I’ve met several professionals who were invested in stocks, such as yes bank, PC Jewellers Idea, etc. In the case of illiquid stocks, there may be no buyers so that stop loss may not get triggered.

Using a Stop Loss Market order is the best chance for the trader to exit the position, in case of a sudden price increase . But the Trade Price could be very different from the Trigger Price if there are not enough sellers available. Using a Stop Loss market order is the best chance for the trader to exit the position in case of a sudden price drop.

It is a good option for day traders to use and limit losses after a certain price movement. You can also use a combination of two Stop Losses to protect your profits and minimise your losses. Suppose you buy a stock at Rs. 100 and set a Stop Loss at Rs. 80 along with a Trailing Stop Loss at Rs. 10. You can also replace the Trailing Stop Loss with another Limit Sell order. This order takes effect in case the stock price touches a high price of, for instance, Rs. 120. Thus, you can limit the risk in your investment portfolio as your losses will be limited.

- Stop losses ensure that you can survive as a trader for much longer.

- When I click on this, you will see a little screen here and, automatically you will see that the quantity is populated, i.e. the quantity that I have bought in my holdings.

- If the Stop Loss is placed at INR 675, then there is a chance that the Stop Loss will get triggered due to the normal price movements of the stock.

- A Trailing Stop loss Order adjusts the stop price at a fixed per cent or value above or below the stock’s market price, depending on the nature of trade.

A stop-loss limit order will be executed at the price that you wish the order to be executed at. The main idea behind these stop-loss orders is to limit the losses and protect gains. A stop-loss order is an order placed to buy or sell a stock when a particular price is reached. A stop loss limit order will be executed at the price that you wish the order to be executed at.

This is to inform that, many instances were reported by general public where fraudsters are cheating general public by misusing our brand name Motilal Oswal. Though we have filed complaint with police for the safety of your money we request you to not fall prey to such fraudsters. You can check about our products and services by visiting our website You can also write to us at , to know more about products and services. Swing high stop loss strategy is used when the trader is doing short-selling.

Leave a comment