Contents:

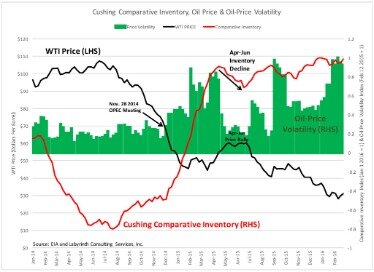

In this case, price retraced approximately 38.2% of a move down before continuing. The appearance of retracement can be ascribed to price volatility as described by Burton Malkiel, a Princeton economist in his book A Random Walk Down Wall Street.

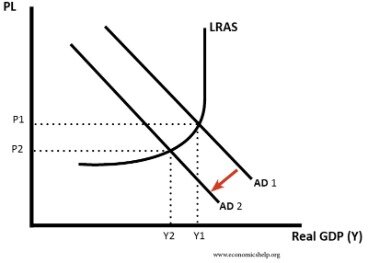

Fibonacci retracement is a popular tool that technical traders use to help identify strategic places for transactions, stop losses or target prices to help traders get in at a good price. The main idea behind the tool is the support and resistance values for a currency pair trend at which the most important breaks or bounces can appear. The retracement concept is used in many indicators such as Tirone levels, Gartley patterns, Elliott Wave theory, and more. After a significant movement in price the new support and resistance levels are often at these lines. In finance, Fibonacci retracement is a method of technical analysis for determining support and resistance levels.

¿Qué Son los Retrocesos de Fibonacci y Cómo Usarlos?

Unlike moving averages, Fibonacci retracement levels are static prices. This allows quick and simple identification and allows traders and investors to react when price levels are tested. Because these levels what is home equity and how does it work are inflection points, traders expect some type of price action, either a break or a rejection. The 0.618 Fibonacci retracement that is often used by stock analysts approximates to the “golden ratio”.

It is named after the Fibonacci sequence of numbers, whose ratios provide price levels to which markets tend to retrace a portion of a move, before a trend continues in the original direction. A Fibonacci retracement forecast is created by taking two extreme points on a chart and dividing the vertical distance by Fibonacci ratios. 0% is considered to be the start of the https://day-trading.info/ retracement, while 100% is a complete reversal to the original price before the move. Horizontal lines are drawn in the chart for these price levels to provide support and resistance levels. The significance of such levels, however, could not be confirmed by examining the data. Arthur Merrill in Filtered Waves determined there is no reliably standard retracement.