Contents:

The complicated rebalancing is one reason these inverse ETPs may not accurately reflect the intended opposite performance of their benchmark beyond that particular day. Both inverse ETFs and ETN are not designed for long-term strategies; they are best used during short-term market swings. The stock market bulls have been marching ahead this year on trade optimism and cheap money flows. Signs of some progress in the U.S.-China trade relation, Brexit doldrums, oil price rally and mixed earnings pulled the stings of the market movement and made these ETFs winners and losers. These currency ETFs gained/lost the most in the past month when the coronavirus outbreak intensified, causing acute global market sell-offs. “There are a couple of different ETF families that have been looking at this index for ETFs, structure products and mutual funds,” he said.

- Messengers, or pad shovers, delivered these quotes by running a circuit between thetrading floorand brokers’ offices.

- If they are, they aim to offer a return two to three times the inverse return of their underlying benchmark before fees.

- “We’re getting a lot of attention from investors and traders who want to see ways that they can participate in the movement of that index,” said John Jacobs, executive vice president and chief marketing officer of the Nasdaq.

- European exchange-traded funds may be excluded from a consolidated tape that gathers together market data for all the equity trades that take place in the European Union.

- Network A reports trades for securities listed on the NYSE, while network B reports trades from NYSE Amex, Bats, ECNs and regional exchanges.

Tape reading is an old investing technique used by day traders to analyze the price and volume of a particular stock to execute profitable trades. Time and sales is a real-time data feed of trade orders for a security showing its time-stamped trading history. Consolidated tape is overseen by the Consolidated Tape Association, and its listed securities data comes from two networks, network A and network B. Network A reports trades for securities listed on the NYSE, while network B reports trades from NYSE Amex, Bats, ECNs and regional exchanges.

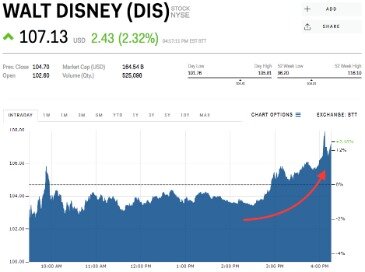

TAPR Stock Price Chart Interactive Chart >

A consolidated tape is viewed as crucial to the next stage of growth for ETFs in Europe with investors currently unable to view the full liquidity picture of ETFs. The Barchart Technical Opinion rating is a 88% Buy with a Strongest short term outlook on maintaining the current direction. Barclays Bank PLC (“Barclays”) announced today that it will exercise its issuer call option and redeem, in full, each series of exchange-traded notes listed in the table below (each, an “ETN” and… Live educational sessions using site features to explore today’s markets. If a user or application submits more than 10 requests per second, further requests from the IP address may be limited for a brief period. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov.

Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. To allow for equitable access to all users, SEC reserves the right to limit requests originating https://day-trading.info/ from undeclared automated tools. Your request has been identified as part of a network of automated tools outside of the acceptable policy and will be managed until action is taken to declare your traffic.

Market Data Vendors

We are continuously working to improve our web experience, and encourage users to Contact Us for feedback and accommodation requests.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. February ETF flow figures from iShares at BlackRock reveal that inflows into global ETPs were moderate for a fifth consecutive…

Last week was downbeat for the broader market owing to uncertainty over the signing of the ??? If you have any problems with your access, contact our customer services team. If you already have an account please use the link below to sign in.

Through the consolidated tape, various major exchanges, including the New York Stock Exchange, the NASDAQ, and the Chicago Board Options Exchange, report trades and quotes. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Please read Characteristics and Risks of Standardized Options before investing in options. Tilman Lueder, head of securities at the European Commission, has poured cold water on the near-term potential of a consolidated tape for ETFs in Europe by arguing the need to introduce one for equities and bonds first. The reason for this, Lueder explained, is portfolio managers optimise out smaller securities from ETFs due to liquidity constraints as they cannot see the average daily volumes without a consolidated tape.

Best & Worst Zones of This Year and Their ETFs

Past performance of a security or strategy does not guarantee future results or success. Not investment advice, or a recommendation of any security, strategy, or account type. Information is provided ‘as-is’ and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use, please see disclaimer. For an ETF, this widget displays the top 10 constituents that make up the fund. This is based on the percent of the fund this stock’s assets represent.

With T+1 compliance set to begin next May, firms will likely be burdened by reduced IT budgets, existing legacy systems and manual processes over the next 15 months. So, while faster settlement will help innovate the middle and back office, some argue industry needs a longer timeline. Inverse ETFs and ETNs aren’t for investors who don’t intend to actively monitor and manage their portfolios. You should conduct thorough research before committing money to any inverse ETPs. If they are, they aim to offer a return two to three times the inverse return of their underlying benchmark before fees.

The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. This reinforces the need for a consolidated tape across fixed income and equity markets. Find exchange traded funds whose sector aligns with the same commodity grouping as the symbol you are viewing.

Consolidated tape is an electronic system that collates real-time exchange-listed data, such as price and volume, and disseminates it to investors. “ETFs have proved extremely resilient through the recent period of market volatility and additive to the overall functioning of markets. The European ETF industry has benefited from the execution transparency delivered through MiFID II by enabling market participants and sophisticated investors to see the volume of ETF trading that occurs daily. You are now leaving the TD Ameritrade Web site and will enter an unaffiliated third-party website to access its products and its posted services. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Inverse ETN market prices are determined in part by the performance of the underlying index. They are also affected by the perceived creditworthiness of their issuer. These derivatives often include various types of futures contracts. These are agreements to buy or sell a particular asset at a set price on an agreed-upon date. As a result, ETF share prices most often correlate to the net asset value of their holdings.

Analysis of these related ETFs and how they are trading may provide insight to this commodity. The ETPs are used to create “short” positions, which bet on a down market, in a large number of securities, commodities, or currencies. You can buy a single product that’s easily traded on an exchange and sell it within the same day. Securities will often trade on more than one exchange; the consolidated tape reports not just the security’s activity on its primary exchange but the trading activity on all of the exchanges. The three factors are based on revenue growth, balance sheet strength, and beta to the price of gold.

Top editors give you the stories you want — delivered right to your inbox each weekday. Currently, CFGE’s portfolio consists of about 35 individual holdings, with Apple, Google, and Facebook given the largest weightings. This report, created by WatersTechnology in association with Regnology, focuses on the state of play across the industry with regard to regulatory reporting. You are currently accessing WatersTechnology.com via your Enterprise account.

Trading

“UCITS products are very popular in those regions due to some of the withholding tax benefits compared to US ETFs but the lack of a consolidated tape is causing them hesitation and they still use US ETFs,” he stressed. One key benefit of aconsolidated tape for ETFs is the increased flow to European-listed ETFs. Shastry predicted the European ETF market is missing out on approximately $1trn assets from Asia and Latin America.

“Trading floor” refers to an area where trading activities in financial instruments, such as equities, fixed income, futures, etc., takes place. A quoted price is the most recent price at which an investment has traded. The quoted price of onetrade forex broker, onetrade review, onetrade information stocks, bonds, and commodities changes throughout the day. While tape is digital today, ticker tape got its name originally from the ticking sound emitted by the mechanical machine which printed long strips of paper with stock quotes.

Trading–Leveraged Equity

The fund tracks theSprott Zacks Gold Miners Index, which uses a transparent, rules-based methodology that is designed to identify gold stocks with attractive investment merit. The U.S. Securities and Exchange Commission and the Financial Industry Regulatory Authority issued an alert during the 2009 financial crisis. They warned prospective inverse ETP investors not to assume that any stated performance objectives apply beyond one day.

Options Protocols

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. Investopedia requires writers to use primary sources to support their work.

Since Thursday, four new ETFs issued by Xtrackers are tradable on Xetra and via the trading venue Börse Frankfurt… “Growth of ETF AUM is being restricted with the lack of a tape due to buy-side clients not being able to see total volume efficiently and quickly in one place.” Barchart is committed to ensuring digital accessibility for individuals with disabilities.

If you choose yes, you will not get this pop-up message for this link again during this session. Barclays launched its Inverse U.S. Treasury Composite ETN , which began trading on July 15. That market data costs too much is a perennial complaint of institutional trading organizations. And sometimes, regulators agree with them, particularly when they conclude that costs are being passed on to individual investors. They provide the opposite performance of an underlying index of securities, commodities, or currencies.